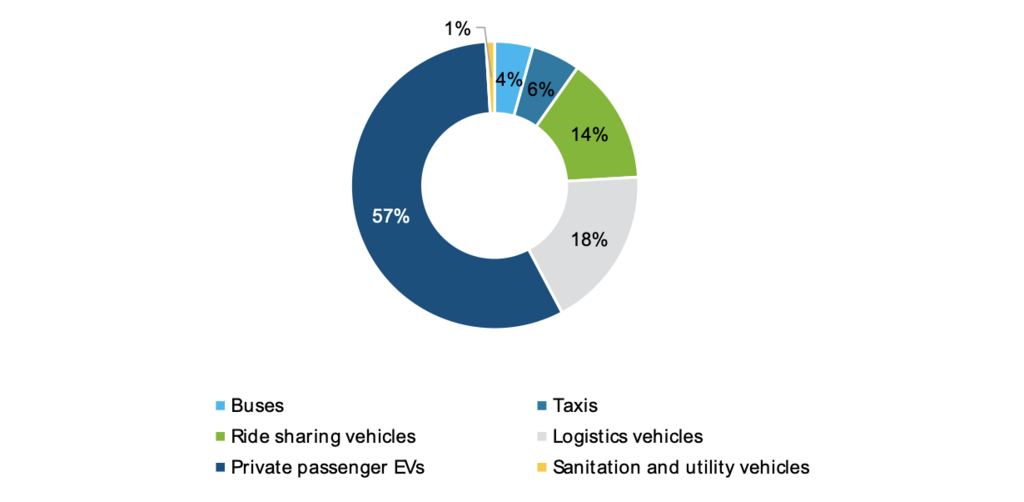

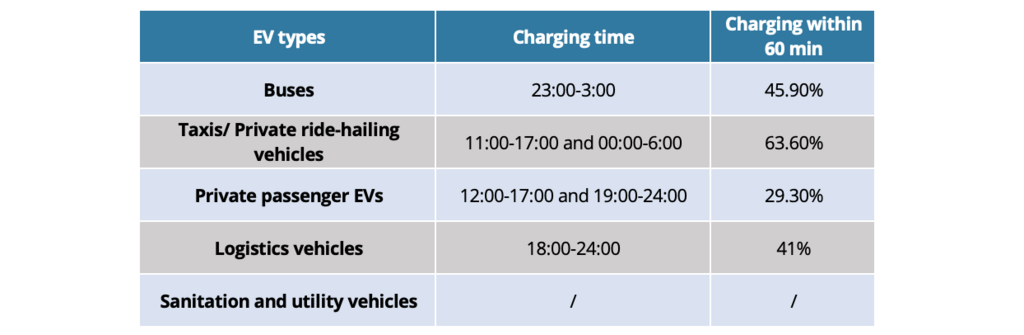

Shenzhen’s charging infrastructure can basically meet the EV charging demand of the city’s vehicle fleet today. However, the location and size of charging facilities is largely based on space availability and grid capacity rather than driving patterns or the preferences of different EV users. These result a variety of challenges that could be addressed by greater collaboration between local transportation and grid authorities with infrastructure operators and user groups.

Shenzhen’s experience shows drawbacks of centralized planning by grid company

The main drawback of Shenzhen’s charging rollout to date has come from the separation of charging infrastructure planning by the grid companies from the actual needs of users and charging station owners and operators. Emphasizing grid connection over other characteristics has accelerated the construction of charging infrastructure, but results in suboptimal placement from the perspective of maximizing utilization or convenience.

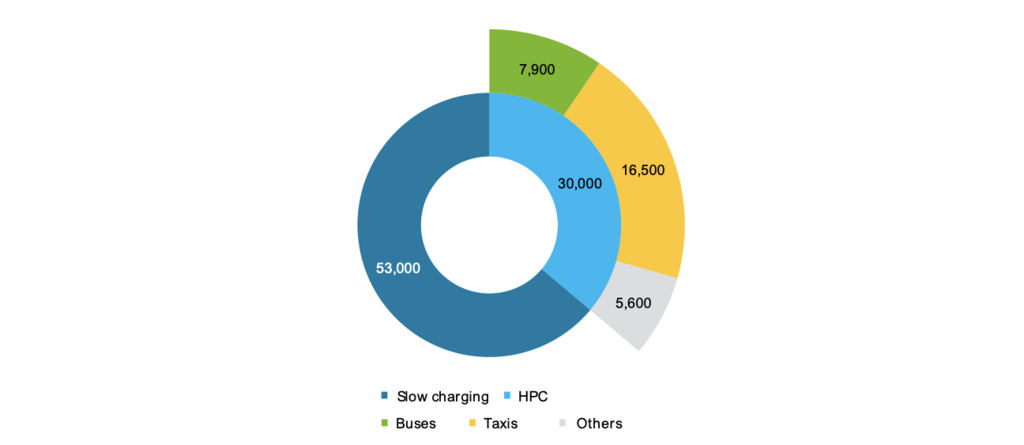

Not only does this discourage investment and financing, but low utilization also doesn’t benefit the grid, since suboptimal placement results in greater need for additional charging investment as well as larger spikes in charging load at dedicated chargers that only serve certain groups. Currently, utilization rates for HPC stations are around 24%, and low-speed public chargers are utilized at around 10%.

Low utilization also affects the incentives for operators to properly maintain charging equipment, repair broken equipment, and share information on charger function with various charging apps. This has been exacerbated by the rushed investment in charging infrastructure starting in 2015, in which a large number of new entrants competed for a limited number of charging locations, not necessarily with regard towards economic efficiency or utilization. Many of these providers adopted their own charging apps, leading to interoperability problems and limited sharing information on charger availability and maintenance.

Currently, Shenzhen is seeking to address these problems while also preparing for a steady increase in EV numbers, especially private passenger EVs and commercial trucks. More centralized supervision of EV infrastructure planning, consolidation of EV charging provider companies, and improvement of residential charging conveniences are among the government’s priorities.

Lessons for other cities: stakeholder engagement, data transparency, and uptake of RE

Shenzhen relied on grid company planning to enable a rapid expansion of public charging infrastructure at places with existing grid capacity. Arguably, wider stakeholder engagement from the outside might have delayed Shenzhen’s charging rollout, since upgrading grid infrastructure would have taken years, and charging behavior of different groups was largely unknown prior to widespread EV adoption in the city. Nevertheless, EV adoption in other cities will likely take place at a slower pace, allowing more widespread engagement with different stakeholders, resulting in more efficient overall charging investments.

The land rush of new charging providers has also contributed to problems with low utilization and a poor user experience, reducing the incentives to maintain or repair charging equipment and share information with users on charger availability. In the case of Berlin, where RLI’s study found that reservation systems and scheduling functions could enable greater utilization and reduced overall infrastructure costs, Shenzhen would likely benefit from EV charging apps with such functions, but this would require greater data sharing among private operators, few of which are likely to share real-time usage or operational information unless required. Consolidation of charging providers will help improve the quality of apps, but will fall short of a fully interoperable app that enables users to see information on scheduling and functioning.

Finally, Shenzhen’s EV charging infrastructure currently lacks a clear connection to uptake of renewable energy. While China’s national government is encouraging the creation of aggregation companies to purchase renewable energy, we were unable to find evidence of such activity in Shenzhen. China also has a national market for green energy, but green energy purchases mainly take the form of monthly or annual contracts for a certain volume of MWh of wind or solar output. Therefore, green energy purchases are not linked to real-time consumption. China Southern Grid has added the green power query function to the Shenzhen page of its website (the Green Power Calendar 绿电历) that theoretically could enable users to see the electricity generation sources at the time of charging, but currently it is not yet fully functional or open to individual users. Time-of-use prices are the only smart charging element currently in place in Shenzhen, and these TOU prices are static on a seasonal basis, rather than reflecting real-time pricing information or renewable output.

Shenzhen represents a unique case of EV adoption. In some respects, Shenzhen is an amazing success, having scaled up EVs to cover a huge number of vehicles in the span of only a few years, with a charging network sufficient to cover its needs. By focusing on buses, taxis, and trucks—vehicles responsible for a large share of emissions and driving mileage—Shenzhen has substantially reduced emissions from transportation sector, with immense benefits for public health.

However, other cities can also learn from the drawbacks of Shenzhen’s rapid charging rollout. Greater stakeholder involvement in infrastructure planning would likely improve both economic efficiency and the user experience. Better interoperability of charging apps would help optimize charging times and reduce the need for new infrastructure investment, while also helping charging providers and the grid. More effort on smart charging could enable greater uptake of renewable energy, reducing the strain on the grid by shifting load to periods when renewable energy is abundant.

To implement the analysis on high power charging, the GIZ-implemented Sino-German Energy Transition project cooperated with two research partners: The China Society of Automotive Engineers (SAE) supported with stakeholder interviews and modeling usage scenarios to investigate the integration of RE and development pathways of HPC infrastructure in Shenzhen. The Reiner Lemoine Institute (RLI) examined HPC development and future charging scenarios in Berlin. The research is carried out under the framework of the Sino-German Energy Transition Project commissioned by the German Federal Ministry for Economic Affairs and Climate Action (BMWK), implemented by GIZ.